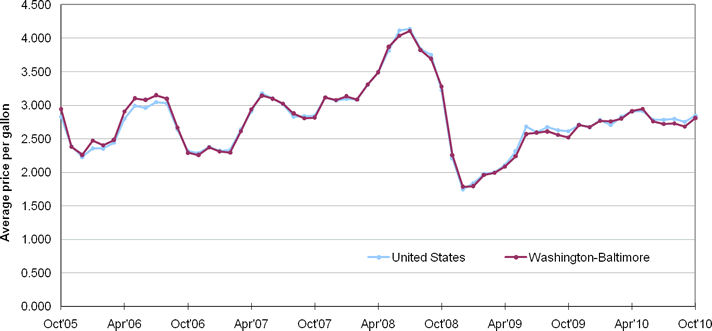

Many people forget that during the summer of 2008 fuel costs were up over $4 per gallon. What happened was all the money that Americans normally spent on McDonalds, Walmart, and other consumer outlets, suddenly went to the excessive fuel costs and a long way to creating the recession we are currently in. Americans were using their expendable income on fuel costs, not on other items in the economy.

And here we go again. Doc Thompson has on a guest that discusses this very issue.

It is unacceptable to have fuel costs higher than what they are now. If fuel costs go up, it is entirely due to the ineptness of our political structures. Americans should not be “nudged” into other forms of energy while our economic competitors fuel their economic engines with unregulated drilling. In America we have regulated ourselves into a poor strategic position.

It is not my fault that our politicians screwed up and stood with weak backs to environmentalists that are in actuality communists at heart and crave an end to American Imperialism by crushing their great independent “car culture.” I will not spend the extra money on fuel. Instead, I will spend less. I will ride my motorcycle when I’d normally take a car. I’ll ride a bicycle or even walk before I use my extra money on a tank of fuel.

America would be wise to only use the fuel it needs, and respond to these price increases by hurting the revenue of all the government hands that have their hands in the cookie jar that is fuel industry. If you want to punch back the government that screwed all this up to begin with, hurt the money they take in with each gallon of gas that you buy. Below is some information on how much we pay in taxes by state for each gallon of gas.

| State | Gasoline | Diesel | Additional Sales Tax | Comment |

| (¢/g) | (¢/g) | (%) | ||

| Alabama | 18 | 19 | 4 | The gasoline gasohol and diesel rates include a 2 cents per gallon inspection fee. Alabama-registered LPG vehicles pay an annual fee based on vehicle type in lieu of the volume tax. |

| Alaska | 8 | 8 | 0 | |

| Arizona | 18 | 19 | 5 | The fuel tax on diesel remains at 18 cents per gallon for light and exempt vehicles but is set at 27 cents per gallon if used to propel a truck with more than two axles or with a declared gross weight over 26 000 pounds. |

| Arkansas | 21.5 | 22.5 | 4.5 | The gasoline gasohol and diesel rates include 0.4 cents per gallon Environmental Assurance Fee. Applicants for LPG user permits must pay a fee in lieu of the volume tax. |

| California | 18 | 18 | 6 | LPG users may pay an annual fee in lieu of the volume tax. |

| Colorado | 22 | 20.5 | 3 | Owners of LPG vehicles registered in the State must pay an annual fee in lieu of the volume tax. |

| Connecticut | 25 | 45.1 | 5 | The tax is computed at 5% of the gross earnings from the first sale of a petroleum product in the State. |

| Delaware | 23 | 22 | 0 | The tax rate varies annually based on the average wholesale price of gasoline for the previous year. |

| Dist. of Columbia | 23.5 | 20 | 5.8 | |

| Florida | 16 | 16 | 0 | Tax rates are variable, adjusted annually. For gasoline and gasohol, in addition to the rates shown, there is a State-imposed State Comprehensive Enhanced Transportation System (SCETS) tax that varies by the county from 0-5.0 cents per gallon. All counties levy the SCETS tax on gasoline, but a few levy less than the maximum rate. LPG vehicles registered in the State pay an annual fee in lieu of the tax on alternative fuels and the SCETS tax. |

| Georgia | 7.5 | 7.5 | 4 | |

| Hawaii | 17 | 17 | 4 | Effective 01/01/02, alternative fuels pay an amount proportional to the diesel tax as follows: .29 for ethanol, .5 for bio-diesel, and .33 for LPG. An additional 1 cent is added to these amounts, and then rounded to the nearest 1 cent. |

| Idaho | 25 | 25 | 5 | LPG users may pay an annual fee based on vehicle weight in lieu of volume tax. |

| Illinois | 19 | 21.5 | Motor carriers pay an additional 6.3 cents per gallon on gasoline, 6.5 cents on diesel, and 5.9 cents on LPG. | |

| Indiana | 18 | 16 | 5 | Motor carriers pay an additional 11 cents per gallon. LPG vehicles pay an annual fee. |

| Iowa | 21 | 22.5 | 5 | Effective 07/01/02, motor fuel tax rates will be adjusted annually based on the amounts of ethanol blended gasoline being sold and distributed annually. |

| Kansas | 24 | 26 | 4.9 | LPG users may pay an annual fee based on mileage and gross vehicle weight in lieu of the volume tax. |

| Kentucky | 24.1 | 21.1 | 6 | Tax rates are variable, adjusted quarterly. A 2 percent surtax is imposed on gasoline and 4.7 percent on special fuels for any vehicle with 3 or more axles. The gasoline, gasohol, and diesel rates include 1.4 cents per gallon Petroleum Environmental Assurance Fee. |

| Louisiana | 20 | 20 | 0 | |

| Maine | 29.5 | 30.7 | 0 | Rates are variable, adjusted every February based on past years Consumer Price Index. Rates are effective on the following July 1. |

| Maryland | 23.5 | 24.25 | 5 | |

| Massachusetts | 21 | 21 | 5 | |

| Michigan | 19 | 15 | 6 | For vehicles defined under the Motor Carrier Fuel Tax Act, diesel fuel is discounted 6 cents per gallon at the pump; and assessed a 12 cents per gallon surcharge on a quarterly return, with a provision for a 6 cent per gallon refund on fuel purchased in Michigan. |

| Minnesota | 27.1 | 27.1 | 6 | There is a credit to the wholesaler of 15 cents per gallon of alcohol used to make gasohol. |

| Mississippi | 18.4 | 18.4 | The gasoline, gasohol, and diesel rates include 0.4 cents per gallon dedicated to the Groundwater Protection Trust Fund. | |

| Missouri | 17 | 17 | 0 | LPG vehicles 18,000 pounds or less gross vehicle weight registered in the State pay an annual fee in lieu of the volume tax. |

| Montana | 27.75 | 27.75 | 0 | LPG vehicles registed in the State pay an annual fee based on gross weight in lieu of the volume tax. Out-of-State vehicles purchase trip permits. There is an alcohol distiller credit of 30 cents per gallon of alcohol produced in the State with State agricultural products and used to make gasohol. |

| Nebraska | 26.8 | 26.8 | 5 | Rates are variable, adjusted quarterly. The gasoline and gasohol include 0.6 cents per gallon and diesel rate includes 0.2 cents per gallon Petroleum Release Remedial Action Fee. Effective 01/01/02, new Nebraska ethanol production facilities may receive an ethanol production credit equal to 18 cents per gallon of ethanol used to fuel motor vehicles. |

| Nevada | 24 | 27 | 0 | |

| New Hampshire | 18 | 18 | 0 | The gasoline, gasohol, and diesel rates include 1.5 cents per gallon Oil Discharge and Disposal Cleanup Fee. Alternative fuel vehicles pay twice the usual registration fee in lieu of the volume tax. |

| New Jersey | 10.5 | 13.5 | 0 | In addition to the rates shown, there is a Petroleum Products Gross Receipts Tax. The tax is computed on a cents-per-gallon basis and is applicable to a wide variety of petroleum products. |

| New Mexico | 18.875 | 22.875 | 5 | The gasoline, gasohol, and diesel rates include the Petroleum Products Loading Fee of $150 per 8,000 gallons (1.875 cents per gallon). Owners of LPG-powered vehicles up to 54,000 pounds gross vehicle weight may pay an annual fee in lieu of the volume tax. |

| New York | 24.35 | 22.55 | 4 | Rates are variable, adjusted annually. Rates include the Petroleum Business Tax of 14.6 cents per gallon. The gasoline rate includes a 0.5 mill (0.05 cents) per gallon Petroleum Testing Fee. |

| North Carolina | 30.55 | 30.55 | 0 | Rates are variable, adjusted semiannually. |

| North Dakota | 22 | 22 | 5 | Rates are variable, adjusted semiannually. |

| Ohio | 28 | 28 | 5 | Commercial vehicles formerly subject to the highway use tax pay an additional 3 cents per gallon. Dealers are refunded 10 cents per gallon of each qualified fuel (ethanol or methanol) blended with unleaded gasoline. |

| Oklahoma | 17 | 14 | 4.5 | Rates shown include 1 cent per gallon tax dedicated to the Petroleum Underground Tank Release Environmental Cleanup Indemnity Fund. When the Fund reaches specified balance, future tax revenues will be deposited in a highway fund. The gasoline, gasohol, and LPG rates include 0.08 cents for fuel inspection. LPG users may pay an annual fee in lieu of the volume tax. |

| Oregon | 24 | 24 | 0 | The diesel and LPG rates shown are paid by users for vehicles not under the jurisdiction of Public Utility Commissioner. Vehicles under the jurisdiction of the Public Utilities Commissioner and paying motor-carrier fees are exempt from payment of the motor-fuel tax. |

| Pennsylvania | 31.2 | 38.1 | 6 | The rates include the Oil Franchise Tax for Maintenance and Construction, a variable rate tax adjusted annually. LPG rate is based on the gasolie gallon equivalent. |

| Rhode Island | 33 | 33 | Rates includes 1 cent per gallon tax for the Underground Storage Tank Financial Responsibility Fund. | |

| South Carolina | 16 | 16 | 5 | |

| South Dakota | 22 | 22 | 4 | As of 7/1/2009, South Dakota taxes gasoline at 22 cents and ethyl alcohol at 8 cents. |

| Tennessee | 20 | 17 | 6 | LPG users without permits must pay in advance at the beginning of the fiscal year, others pay quarterly. Fee is based on vehice weight and fuel efficiency. |

| Texas | 20 | 20 | 6.3 | Owners of LPG vehicles registered in the State must pay an annual fee in lieu of the volume tax. |

| Utah | 24.5 | 24.5 | 4.9 | LPG is tax exempt if user purchases annual exemption certificate. |

| Vermont | 20 | 29 | 0 | Diesel vehicles 10,000 pounds and over pay 26 cents per gallon. LPG vehicles are subject to a registration fee 1.75 times the usual fee. The gasoline, gasohol, and diesel rates include 1 cents per gallon for the Petroleum Cleanup Fund. |

| Virginia | 17.5 | 17.5 | 0 | Vehicles weighing 26,000 pounds or more having 3 or more axles pay an additional 3.5 cents per gallon. |

| Washington | 37.5 | 37.5 | 6.5 | Owners of LPG vehicles pay an annual fee. |

| West Virginia | 32.2 | 32.2 | 0 | Rates are variable, adjusted annually. |

| Wisconsin | 30.9 | 30.9 | 5 | Rates are variable, adjusted annually. |

| Wyoming | 14 | 14 | 4 | LPG is subject to sales tax. The gasoline, gasohol, and diesel rates include 1 cent for the Underground Storage Tank Corrective Action Account. |

There is no reason for gas to go over $3 a gallon. If you put up with it, it’s your own fault. Our economy has not yet recovered from the last recession. The arrogance of politicians who believe Americans have enough expendable income to ride the fuel price hikes are at best out of touch. And the best way to hurt a politician is to take away the money they rely on. So lower your consumption and therefore the revenue politicians collect at the gas pumps.

Rich Hoffman

http://twitter.com/#!/overmanwarrior

www.overmanwarrior.com